Written By Divya

Published By: Divya | Published: Sep 18, 2025, 10:49 PM (IST)

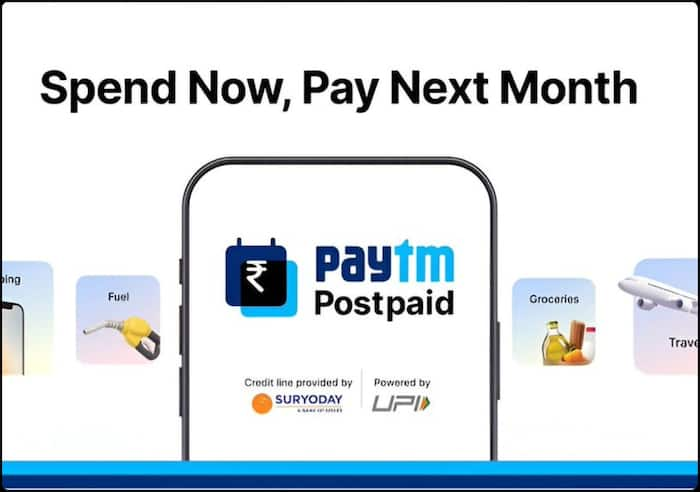

Paytm has rolled out a new feature called Postpaid on UPI, which allows you to spend instantly and pay back the following month. The service has been launched in partnership with Suryoday Small Finance Bank and is supported by NPCI. In simple words, it adds a short-term credit line directly to your UPI payments. Also Read: Paytm Launches AI-Powered Travel App ‘Paytm Checkin’ To Book And Plan Everything

With Paytm Postpaid on UPI, you don’t need to worry about paying on the spot every time you make a purchase or clear a bill. The feature works across all UPI merchants, whether you’re scanning a QR at your neighbourhood shop, shopping online, or just recharging your phone and paying household bills. The process is the same as any other UPI transaction, but instead of the money being deducted right away, you get up to 30 days of interest-free credit. That way, you can spend through the month and settle the amount in one go when the next cycle begins. Also Read: No PIN Needed: Google Pay, Paytm, And PhonePe Users Can Pay Using Fingerprint Or Face Scan

At present, Paytm Postpaid on UPI is being rolled out in phases. A selected group of users, identified based on their spending behaviour, will be able to use the service first. Over time, Paytm will expand access to more users. Also Read: Paytm Will Now Remind You About Your Pending Expenses! Here’s How To Use It

If you’re eligible, here’s how you can set it up:

Managing monthly expenses can sometimes feel tight, especially toward the end of the month. Paytm Postpaid on UPI adds a layer of flexibility by letting you pay later while still using the same UPI process you’re already familiar with.