Written By Shubham Arora

Published By: Shubham Arora | Published: Jan 21, 2026, 12:10 PM (IST)

Apple may be planning to bring its tap-to-pay service, Apple Pay, to India. A recent report suggests it could arrive by the end of 2026. The rollout is expected to depend on regulatory approvals and agreements with Indian banks and card networks. Also Read: iPhone 18 Pro vs iPhone 17 Pro: 5 biggest changes that will change the overall experience

Apple has been looking at launching Apple Pay in India for some time. As per a Business Standard report, the company has been in discussions with regulators, banks, and card issuers to understand what is needed to bring the service to the country. Also Read: 6 best tablets under Rs 40,000 that are worth your money in 2026

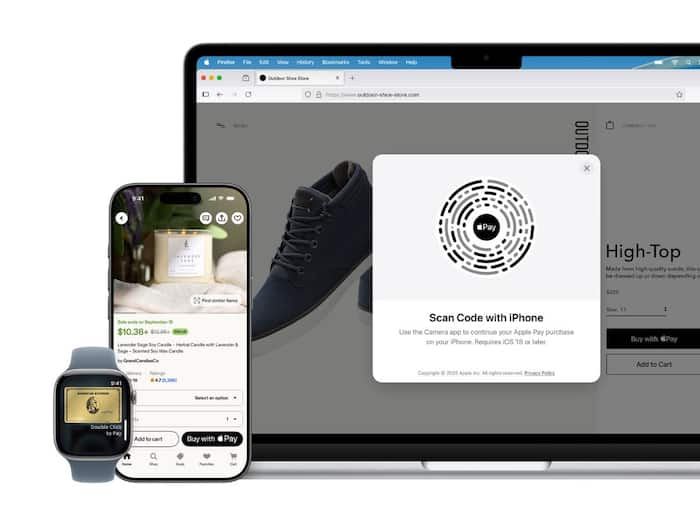

If Apple Pay does launch, it is expected to start with tap-to-pay support. This would let users make payments by tapping their iPhone or Apple Watch on compatible card machines using NFC.

Users would be able to store their credit or debit card details in Apple Wallet and complete payments without using a physical card. At present, Apple Wallet does not support adding Indian-issued cards, which means Apple will need to finalise commercial arrangements with card issuers before the service can go live.

These arrangements are expected to include discussions around transaction fees and backend payment processing. Until those are finalised, Apple Pay cannot be enabled for Indian users.

Apple Pay works only on Apple devices, including iPhones, Apple Watches, iPads, and Macs. It does not support non-Apple devices. This is different from payment apps commonly used in India, which are built around UPI and work across platforms.

Because Apple Pay relies on NFC-based card payments, it would mainly be used at physical stores with compatible terminals. At launch, Apple Pay is not expected to support QR-based UPI payments or peer-to-peer transfers.

This means Apple Pay is unlikely to replace existing payment apps. The service would work alongside existing payment apps and mainly be used for card payments at physical stores.

These reports come as Apple’s presence in India continues to grow. The company has recorded its highest iPhone shipments in recent quarters, showing a steady increase in users.

With more people using iPhones in the country, rolling out services like Apple Pay becomes easier. That said, India’s digital payments space is already dominated by UPI, which could limit how widely Apple Pay is used, at least in the initial phase.

Apple has not officially confirmed any plans to launch Apple Pay in India so far. The final timeline will depend on regulatory approvals and tie-ups with banks and card networks.