Written By Divya

Published By: Divya | Published: Jan 14, 2026, 05:51 PM (IST)

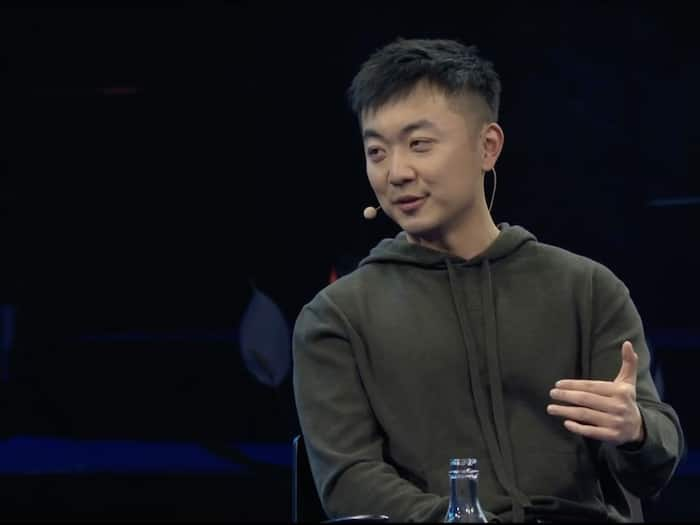

2025 has already launched a slew of flagship smartphones that come with a significant price hike. One of the key reasons that tech giants and experts have explained is the jump in the chipset prices. Now, 2026 seems like the new phones will get more costly, Nothing’s CEO Carl Pei warned. He says that the smartphone industry is heading into an uncomfortable phase where price hikes may become unavoidable. Also Read: Carl Pei ruins Apple’s event invite to announce Nothing Phone (4a) series launch date

In a post on X (formerly Twitter), Pei described 2026 as an “unprecedented” year for consumer electronics, especially smartphones. The core issue, he says, is not design or innovation, but memory. Also Read: Carl Pei inaugurates Nothing’s first India flagship store in Bengaluru

For years, phone makers benefited from falling component costs, he explained. That allowed brands to offer better hardware every year without pushing prices up too much. According to Pei, that era is ending now. Also Read: 7 best smartphones under Rs 25,000 in 2026

Memory components like NAND and DRAM (Dynamic Random Access Memory) are becoming more expensive, largely because AI companies are buying them in massive volumes for data centres. The same chips that go into smartphones are now being prioritised for AI infrastructure, leaving phone makers with higher bills and less bargaining power.

As a result, memory, once a manageable cost, is turning into one of the most expensive parts of a smartphone.

In such a scenario, brands have a difficult choice to make: either raise prices or cut specs! Nothing, he confirmed, is choosing the former. Smartphones launching from the brand in Q1 2026 will see an “inevitable” price increase rather than a downgrade in experience.

This decision also explains why Nothing is planning to upgrade some mid-range models to UFS 3.1 storage, moving away from older UFS 2.2. While this improves speed and responsiveness, it also adds to the overall cost.

According to Pei, budget and mid-range phones are the most vulnerable. These segments already run on tight margins, leaving little room to absorb rising component prices. He also hinted that 2026 could mark the end of the long-running “specs race.” Instead of chasing numbers, brands may shift focus toward user experience, software, and design, areas where hardware inflation hurts less.