Written By Shubham Arora

Published By: Shubham Arora | Published: Jan 30, 2026, 04:48 PM (IST)

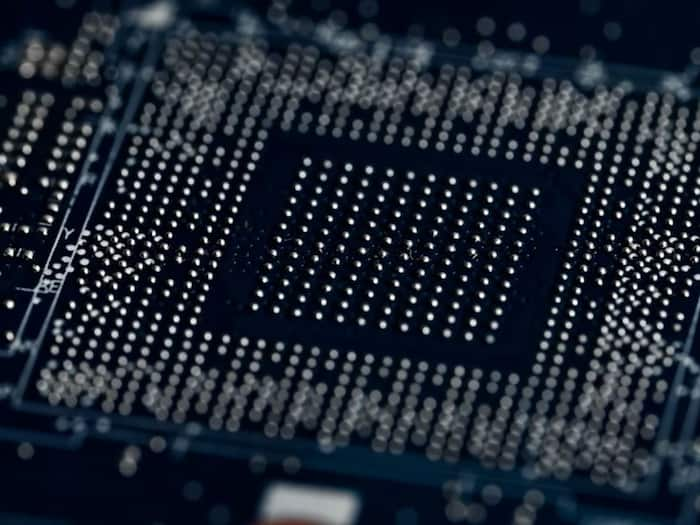

Global smartphone processor shipments are expected to slow down next year, even as premium devices continue to gain traction. According to a new report by Counterpoint Research, worldwide smartphone system-on-chip (SoC) shipments are projected to decline by 7% year-on-year in 2026, mainly due to rising memory costs and supply-side pressures. Also Read: Tim Cook says Apple sees a ‘huge opportunity’ in India after record quarter

Counterpoint’s Global Smartphone SoC Model Shipments and Revenue Tracker points to increasing memory prices as the biggest factor behind the expected decline. The report notes that RAM prices are rising due to a shortage, as memory suppliers are prioritising high-margin HBM production for AI data centres over smartphone components. Also Read: Apple confirms another Mumbai Store as the 6th Store in India; location to be revealed soon

The impact is expected to be most visible in the entry-level segment. Smartphones priced below $150 (around Rs 13,800) are likely to face the most pressure, as brands in this range have limited flexibility to absorb higher component costs. With margins getting tighter, some manufacturers may reduce shipments, which would in turn affect overall SoC volumes. Also Read: Gemini and Google AI Mode to help you prepare for JEE Main exam: Here's how

Chipmakers that depend largely on 4G and entry-level 5G smartphones are expected to feel more strain than those focused on mid-range and premium devices.

The report points out that brands with in-house chip development may be slightly better positioned in the short term. Brands such as Samsung, Google, Huawei, and Xiaomi, may be in a relatively better position to manage rising costs due to greater control over their supply chains. Counterpoint adds that even brands that are currently better placed could run into problems if memory shortages continue for a longer time.

While shipments are expected to decline, Counterpoint says overall SoC revenue could still grow in 2026. This is mainly linked to premiumisation, as more consumers continue to move towards higher-priced smartphones.

The report estimates that nearly one in three smartphones sold next year will be priced above $500 (around Rs 46,000). As brands focus more on these segments, they are likely to use costlier mid-premium and flagship chipsets, pushing average selling prices higher even as shipment volumes fall.

The report also highlights a technology shift expected next year. At the higher end, flagship smartphones launching in 2026 are expected to shift from 3nm to 2nm chipsets. Samsung is expected to be among the first to begin mass production of a 2nm smartphone processor, the Exynos 2600, with other players expected to follow.

Counterpoint says the premium trend is likely to benefit companies such as Apple and Qualcomm, both of which already have a strong presence in the high-end segment. MediaTek is also said to be closing the gap in premium Android devices, adding more competition at the top end of the market.