Written By Shubham Verma

Edited By: Shubham Verma | Published By: Shubham Verma | Published: Feb 08, 2023, 11:15 AM (IST)

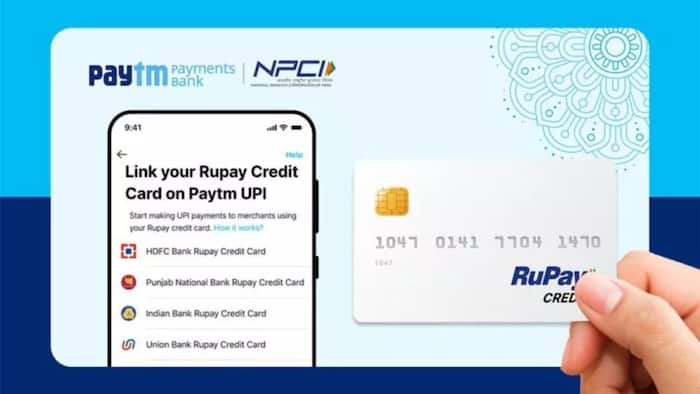

Paytm Payments Bank has launched a RuPay Credit Card on UPI, giving users registered with the bank an option to make payments on credit without having to carry the card all the time. Since the credit card needs to be linked with a customer’s UPI account, it allows making payments by scanning QR codes at merchants. Paytm Payments Bank said that the RuPay Credit Card on UPI will offer convenient payments through a greater acceptance of RuPay credit cards. Also Read: Blinkit launches Rs 50 Bharat Yatra Card for metro and bus travel across India: How to get it

Paytm Payments Bank said both offline and online payments are supported by the RuPay Credit Card and linking it to a customer’s UPI ID makes payments faster. Also Read: Apple Pay could arrive in India soon, but with key limitations: What we know so far

“We are launching payments through RuPay Credit Card on UPI in partnership with NPCI, and believe that this will enable the convenience of payments, while also leading to greater penetration of the credit ecosystem in India,” said Surinder Chawla, MD and CEO of Paytm Payments Bank in a release. Also Read: EPF Withdrawal Via UPI May Start Soon: What Subscribers Need To Know

The RuPay Credit Card has been launched by Paytm Payments Bank in partnership with the National Payments Corporation of India (NPCI). A Paytm Payments Bank customer can apply for the RuPay Credit Card and after linking it with UPI, they can utilise the allocated limit to pay using QR codes. The Reserve Bank of India approved the linking of RuPay credit cards with UPI for a “digitally enabled credit card lifecycle experience for users.”

“RuPay Credit Cards on UPI provide an unmatched user experience by combining the ease of UPI with RuPay Credit Cards. The rewards and benefits of RuPay Credit Cards will further be enhanced with the experience of digital enablement and the convenience of making all types of payments through a single UPI app,” Praveena Rai, COO of NPCI, said in a statement.

Paytm Payments Bank said it remained the largest UPI beneficiary bank for 19 months in a row with over 1,726.94 million transactions in December 2022. Meanwhile, PhonePe strengthened its position as the leader in the UPI transactions market with a share of over 50 percent in December 2022. Both Paytm and PhonePe are also reportedly working on integrating the UPI Lite services into their apps.