Written By Pranav Sawant

Published By: Pranav Sawant | Published: Jun 19, 2024, 02:58 PM (IST)

If you are a salaried person, earn some money from your business, or are a freelancer earning good cash, you indeed have a PAN card. A PAN card is required for various financial purposes, such as to open a bank account, file income tax, and get a credit or debit card. You also need a PAN for investing in the stock market or mutual funds. Having said that, you need to keep your PAN card active all the time. However, if you suspect that it’s inactive for some reason, then you need to get it activated as soon as possible. But how does one check if their PAN card is active or inactive? In this guide, we will show you exactly that. Also Read: Aadhaar-PAN Linking Deadline Nears: What Happens If You Miss It, How To Link Online

Before we move towards the step-by-step guide, there are some prerequisites you need to follow. You need to know your PAN number, which is mentioned on the front of your PAN card, and a valid/registered mobile number. With that said, let’s see the exact steps of checking your PAN’s status. Also Read: Everything you need to know about PAN 2.0: What is it and how it works

Also Read: What is PAN 2.0 Project? How to and should you apply for it?

The government allows users to check the status of their PAN card on the Income Tax portal.

Step 1: Open the official Income Tax e-filing website.

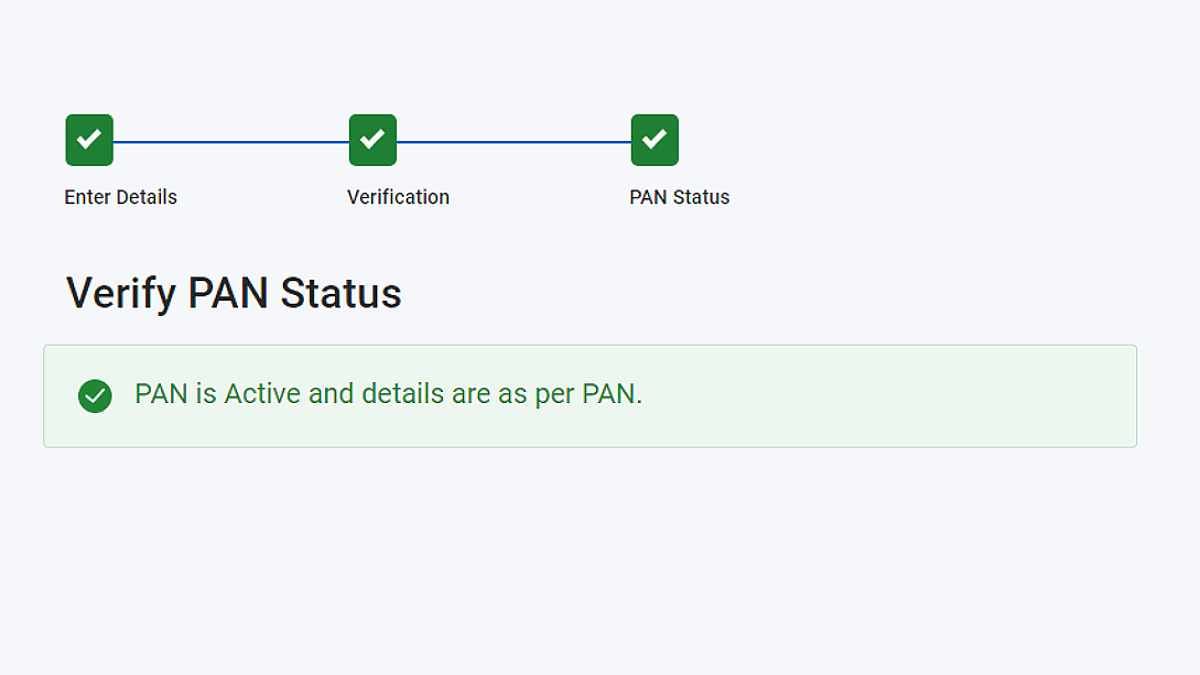

Step 2: Once you are on the Income Tax e-filing website, you should see a Quick Links tab on the left side. Look for Verify PAN Status and tap on it.

Step 3: Enter our PAN card number, Date of Birth, Full Name, and Mobile number.

Step 4: After entering all the details, hit Continue.

Step 5: Now, you will have to do the verification using the OTP that you will receive on your mobile number.

Step 6: After verification, you should see the statute of your PAN card.

That’s how easily you can check the status of your PAN card. If your PAN card is active, that’s great. But if it’s inactive, you will have to draft a PAN Reactivation letter and send it to the Jurisdictional Assessing Officier (AO) in the Income Tax Department.